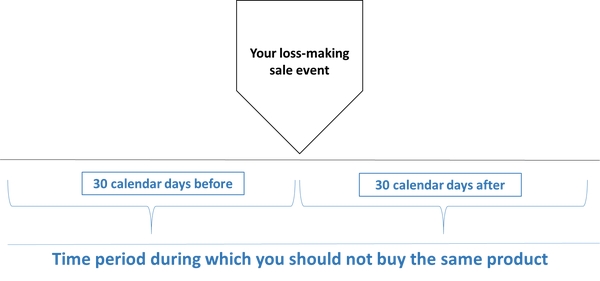

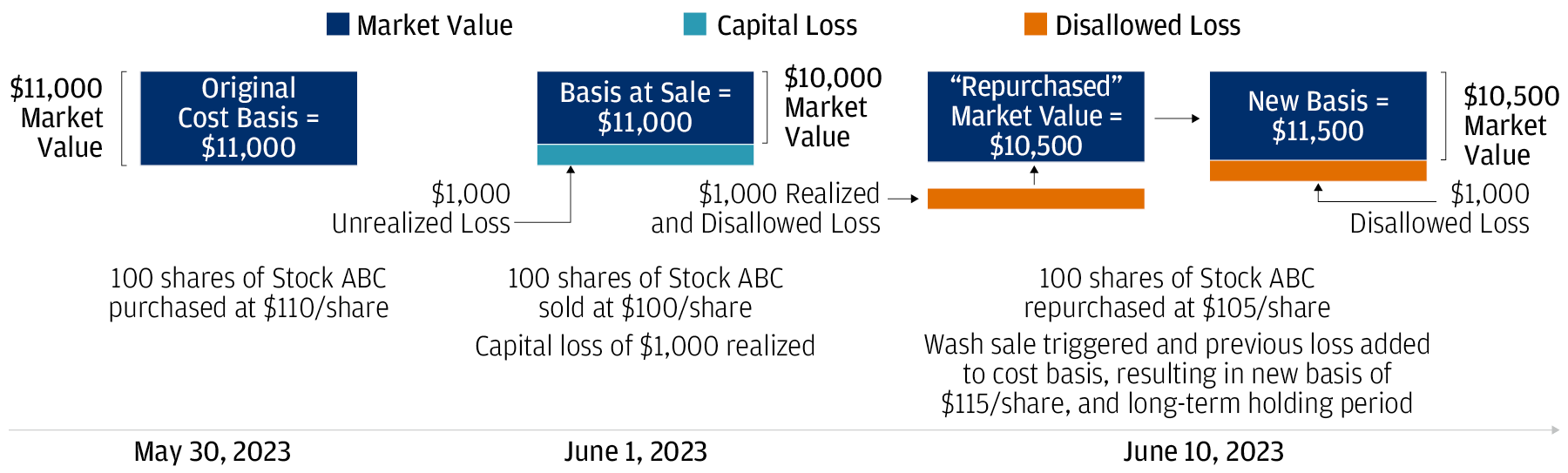

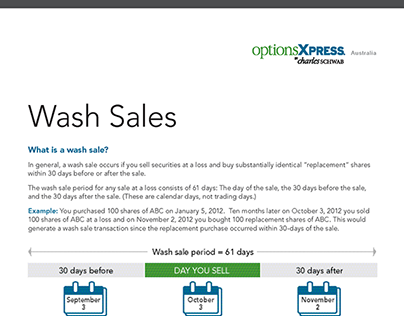

Is A Wash Sale 30 Calendar Days – If you sell stock or securities for a loss, the wash sale rule applies if you acquire one of the following within 30 days before or after the sale: Substantially identical stock or securities in a . If you sell stock or securities for a loss, the wash sale rule applies if you acquire one of the following within 30 days before or after the sale: Substantially identical stock or securities in a .

Is A Wash Sale 30 Calendar Days

Source : www.fool.com

What Is the Crypto Wash Sale Rule? | Bybit Learn

Source : learn.bybit.com

Wash sale definition and meaning Market Business News

Source : marketbusinessnews.com

Understanding Wash Sale Rules to Optimize Capital Gains

Source : fastercapital.com

Wash Sale Overview, How It Works and Practical Example

Source : corporatefinanceinstitute.com

For your year end tax planning, beware the wash sale rule | J.P.

Source : privatebank.jpmorgan.com

Wash Sale Rule: What To Avoid When Selling Your Losing Investments

Source : www.bankrate.com

For Your Year end Tax Planning, Beware the Wash Sale Rule | J.P.

Source : www.jpmorgan.com

Financial Services Brochure Projects :: Photos, videos, logos

Source : www.behance.net

What Is the Crypto Wash Sale Rule? | Bybit Learn

Source : learn.bybit.com

Is A Wash Sale 30 Calendar Days Wash Sale Rule: What it is and How to Avoid | The Motley Fool: On its surface, the wash sale rule isn’t very complicated. It simply states that you can’t sell shares of stock or other securities for a loss and then buy substantially identical shares within 30 . You’ll only have until the end of the calendar year to position Because you’ve repurchased the stock within the 30-day window, you have a wash sale. So you won’t be able to claim a .