Calendar Year Deductible Explained – The Internal Revenue Service offers taxpayers two options for reducing their taxable income: itemizing deductions or taking something called the standard deduction in your annual accounting period . Deductibles are generally much larger than copays, but you only have to pay them once a year (unless you’re on Medicare, in which case the deductible applies to each benefit period instead of .

Calendar Year Deductible Explained

Source : www.deltadentalwa.com

OOP Out of Pocket Maximum calendar year deductible meanings

Source : individuals.healthreformquotes.com

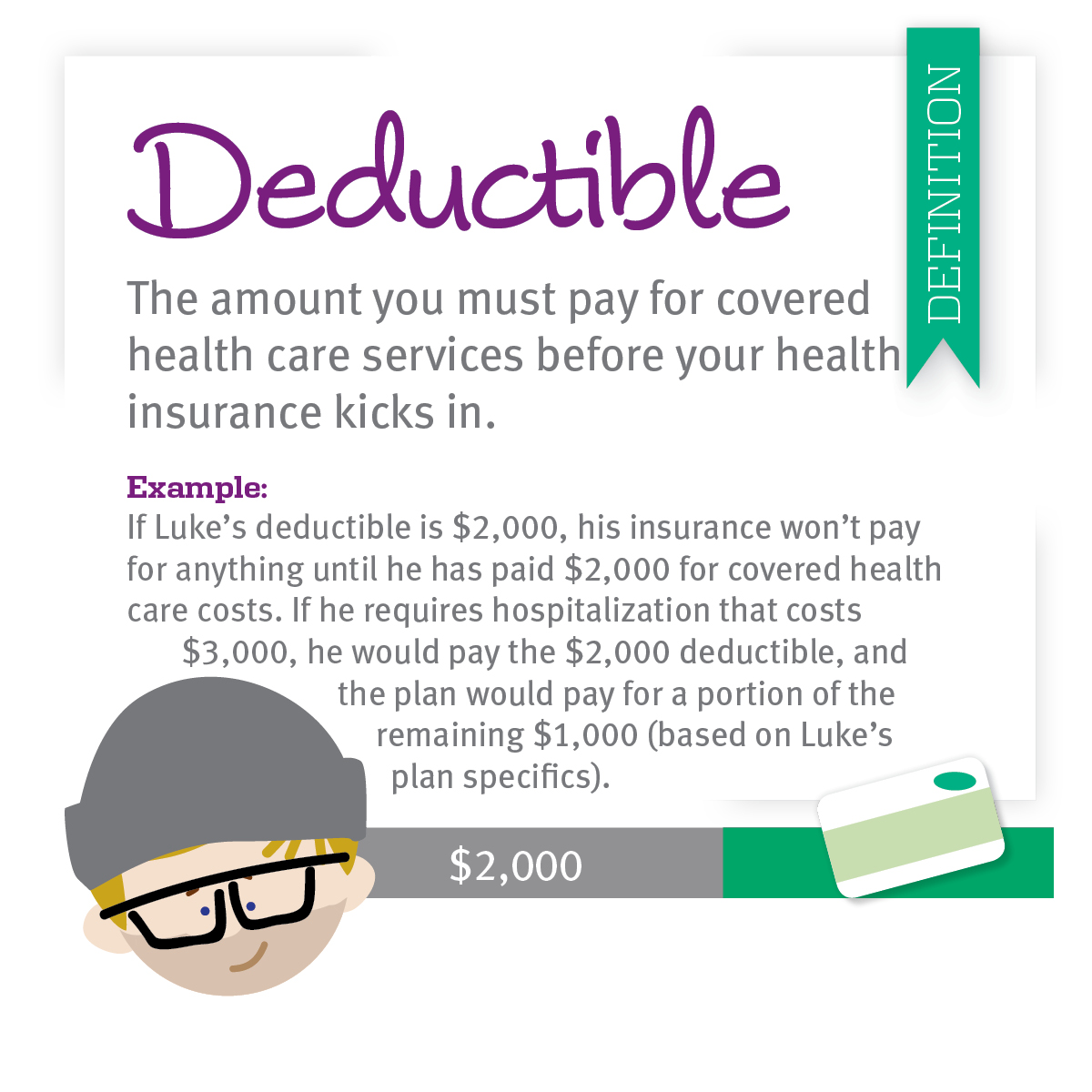

What is a Deductible? Guide to Health Insurance Deductibles | eHealth

Source : www.ehealthinsurance.com

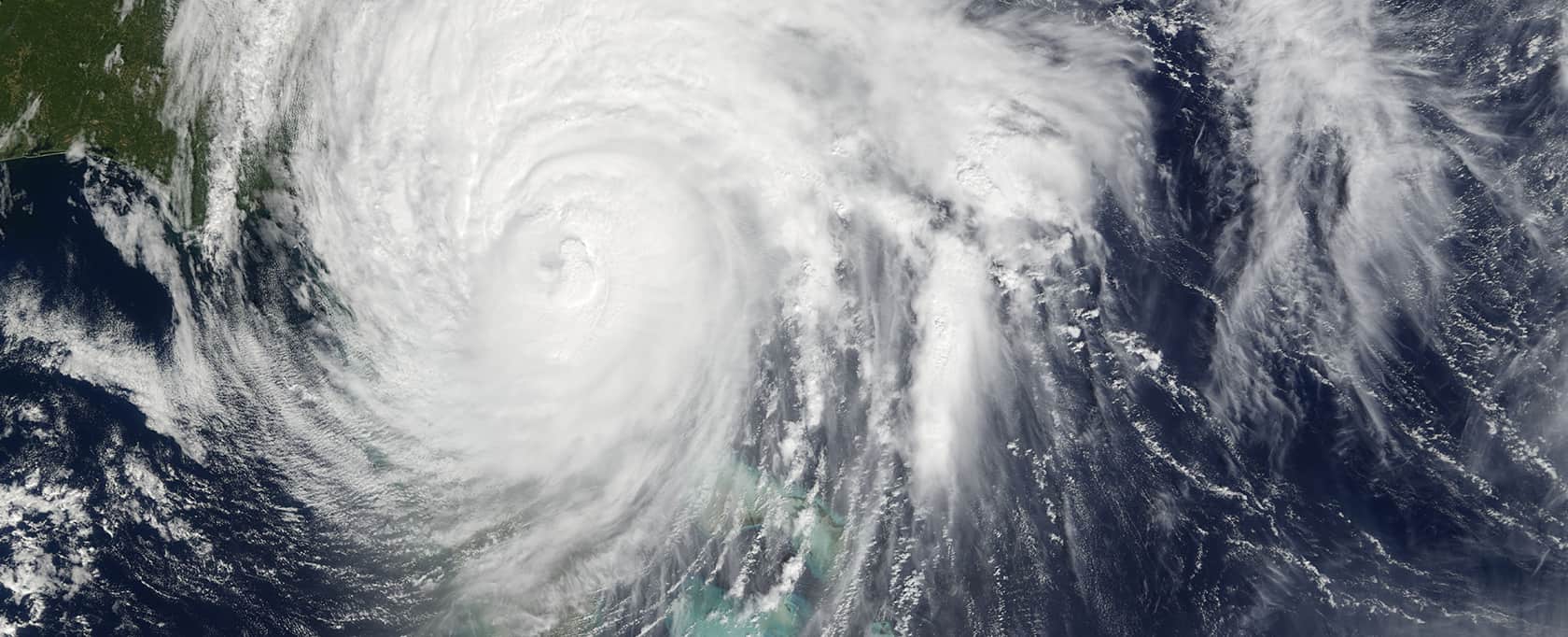

What is a hurricane deductible? Tower Hill Insurance

Source : www.thig.com

Dental Insurance Deductibles Explained | Delta Dental

Source : www.deltadental.com

What Is a Dental Insurance Deductible? | Delta Dental Of Washington

Source : www.deltadentalwa.com

Deductibles – Royalton Psychological Associates, LLC

Source : www.royaltonpsych.com

Medicare’s Calendar Year & Benefit Periods Explained | MedicareFAQ

Source : www.medicarefaq.com

Understanding “Plan Year” Vs “Calendar Year”: Key Health Insurance

Source : www.decent.com

Health Insurance Deductible Met? | Brandon P. Donnelly, MD

Source : brandondonnellymd.com

Calendar Year Deductible Explained What Is a Dental Insurance Deductible? | Delta Dental Of Washington: In health insurance, the deductible works on an annual basis, and after your new policy year begins, the running total of what you’ve paid will reset to zero. This could mean that your health care . Learn about our editorial standards and how we make money. You choose your deductible at the time you purchase home insurance, but you can change it at any time during your policy term. The amount you .