Calendar Spread Put – Typically, the long position is established with a call or put option, while the short position involves the opposite option type. The goal of a long calendar spread is to capitalize on the time . A calendar spread, as the name suggests is a spread strategy wherein you trade on the gap between two similar contracts rather than betting on the price. This is considered to be relatively low .

Calendar Spread Put

Source : www.fidelity.com

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Source : optionalpha.com

Short Calendar Spread with Puts Fidelity

Source : www.fidelity.com

The Poor Man’s Covered Call (and other Calendar Spreads) : r

Source : www.reddit.com

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Source : optionalpha.com

Long Put Calendar Spread (Put Horizontal)

Source : www.optionseducation.org

Calendar Spread: What is a Calendar Spread Option? | tastylive

Source : www.tastylive.com

Put Calendar Spread

Source : oahelp.dynamictrend.com

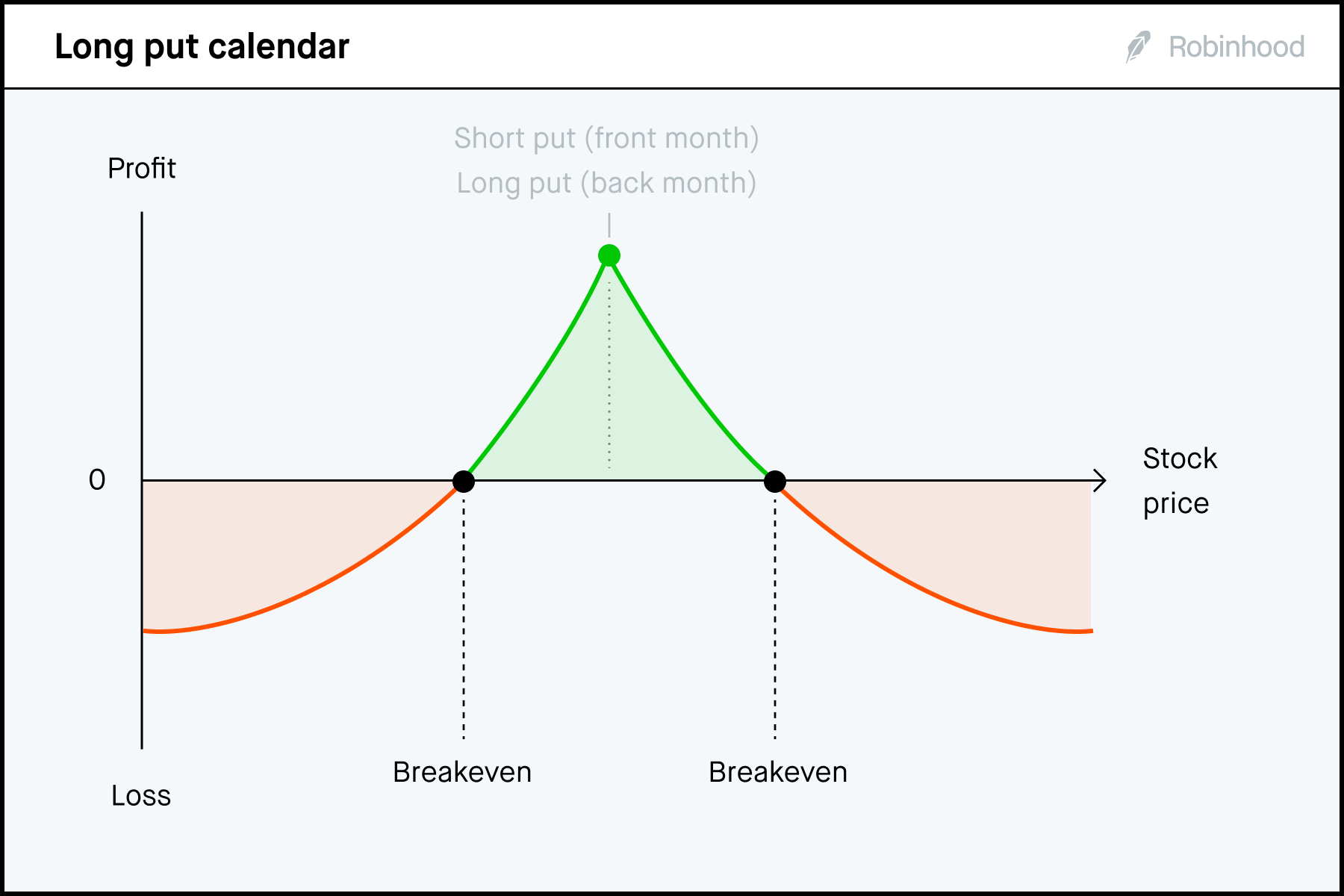

Advanced options strategies (Level 3) | Robinhood

Source : robinhood.com

Calendar Put Spread – Options Edge

Source : theoptionsedge.com

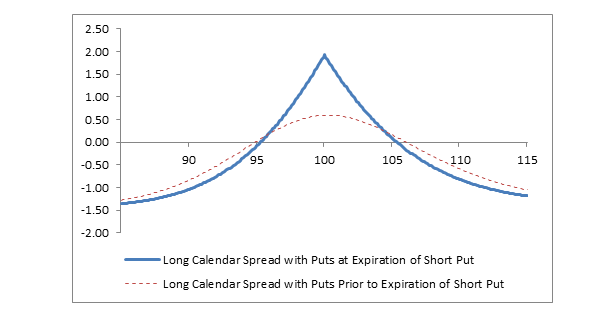

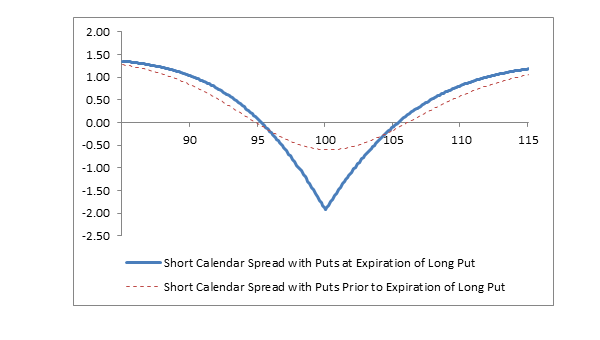

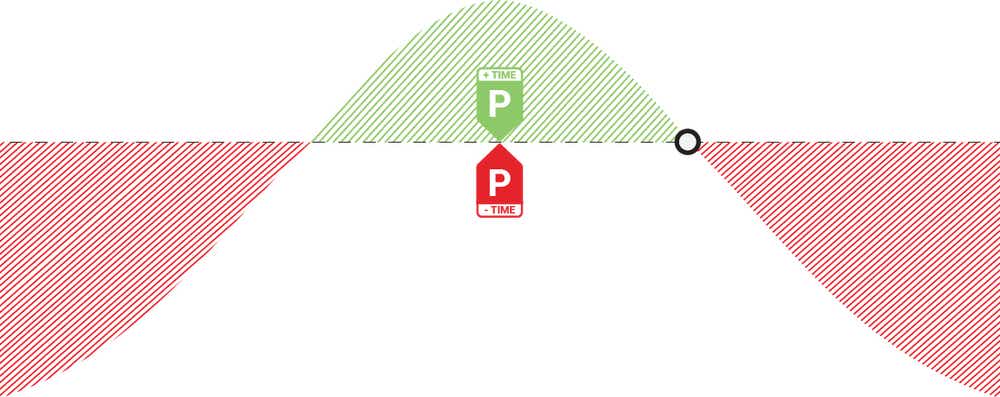

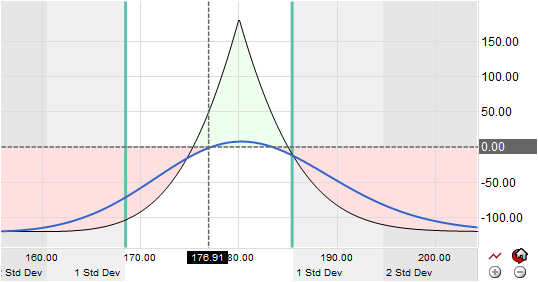

Calendar Spread Put Long Calendar Spread with Puts Fidelity: Traders can use calls or puts and they can be set up to be neutral With Alphabet stock trading at $170, setting up a calendar spread at $175 gives the trade a neutral to slightly bullish . Calendar spread indicate what is the gap in prices of two different expiry contracts of a particular commodity. This shows whether that commodity is moving in contango or backwardati .